The Chinese economy has witnessed tremendous transition and

growth since 1978 when Deng Xiaoping introduced China to capitalist

market reforms and moved away from a centrally planned economy. The resulting growth has persisted for the last 35 years; its gross domestic product

(GDP) has seen an average annual growth rate of 10.12% between 1983 and

2013, making China's economy the second-largest in the world. China's

transformation from a sleeping rural, agricultural giant to

manufacturing and service sector kingpin had brought rapid

infrastructure development, urbanization, rising per capita income and a big shift in the composition of its GDP. (For more, see: The GDP and its Importance.)

China’s GDP is broadly contributed by three broader sectors or industries – primary industry (agriculture), secondary industry (construction and manufacturing) and tertiary industry (the service sector). As per the 2013 data, primary industry accounted for 10% of GDP, while secondary industry accounted for 44%, and tertiary industry 46%.

Massive Agricultural Sector

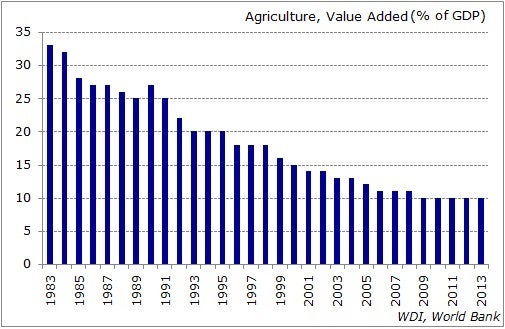

China is the world’s largest agricultural economy with farming, forestry, animal husbandry and fisheries accounting for approximately 10% of its GDP. This percentage is much higher than developed countries, such as the United States, the United Kingdom and Japan, where agriculture makes up about 1% of GDP. The chart below shows the trend in the share of agriculture in GDP (1983-2013). Though the percentage has gradually decreased over the years, it still accounts for approximately 34% of the total employed population. Over the last seven years, the share of agriculture as part of GDP has held more or less constant at 10%.

The economic reforms of 1978 changed the face of agriculture in China. Prior to these reforms, four out of five Chinese worked in agriculture. But this changed as property rights in the countryside took hold and led to the growth of small nonagricultural businesses in rural areas. De-collectivization, coupled with better prices for agricultural products, led to more productivity and more efficient use of labor. The other major change took place in 2004 when the farm sector started to receive increased support under a major shift in economic policy wherein the government came up with policies to support the agriculture sector rather than overtax it, which was the previous policy. (For more, see: Top Agricultural Producing Countries.)

China is a global producer of rice, cotton, pork, fish, wheat, tea,

potatoes, corn, peanuts, millet, barley, apples, cotton, oilseed, pork,

fish and more. Government support and low labor costs help its

agricultural products stay profitable, though a fragmented

transportation network and a lack of sufficient cold-storage

infrastructure act as a dampener. (For more, see: China ETFs: Get in as China Matures.)

Construction and Industry

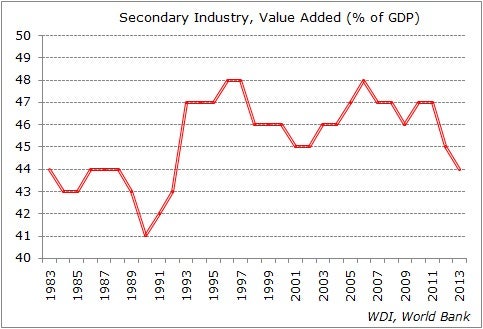

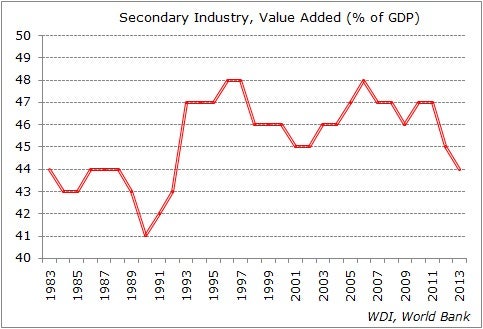

Construction and industry (including mining, manufacturing, electricity, water and gas) accounted for 44% of China's GDP in 2013. Industry is the bigger contributor (84% of the secondary industry), while construction accounts for just 7% of overall GDP. The chart below shows the percentage of secondary industry in China’s GDP from 1983 to 2013. Overall, this sector has held its dominance and seen minimal change in its percentage composition in the overall GDP over the years. Approximately 30% of China's employed population works in these secondary industries. (For more, see: Investing in China's Roads and Railways.)

The share of secondary industries as part of GDP in China is more than in countries such as India (25%), Japan (26%), the U.S. (20%) and Brazil (25%). China is a world leader in industrial output, including mining and ore processing, processed metals, petroleum, cement, coal, chemicals and fertilizer. It's also a leader in machinery manufacturing, armaments, textiles and apparel. Add to that, China is a top manufacturer of consumer products, a leader in food processing, and a major maker of telecommunications equipment. It's a growing manufacturer of automobiles, train equipment, ships, aircraft and even space vehicles, including satellites.

The Service Sector

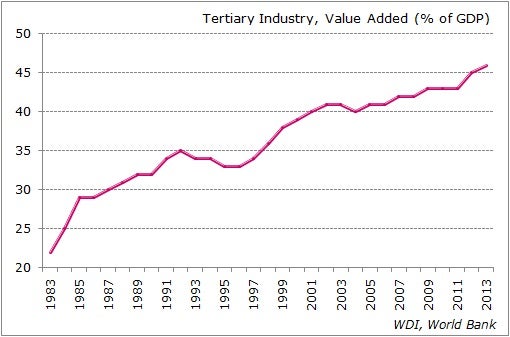

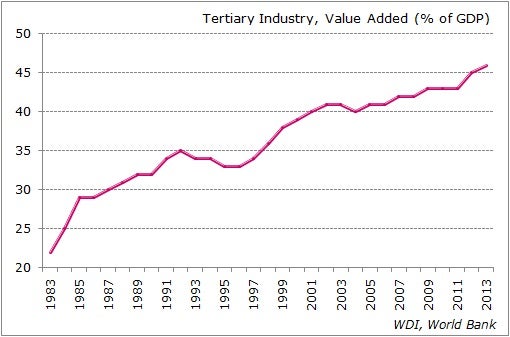

China's service sector has doubled in size over the last two decades to account for about 46% of GDP. In 2013, it surpassed China's the secondary industries for the first time. Within the service sector are transport, storage and post (5% of GDP), wholesale and retail trades (10%), hotel and catering services (2%), financial services (6%), real estate (6%) and mishmash of services categorized as 'other' (18%).

China’s focus on manufacturing left the service sector to its own devices for many years, with both substantial barriers to trade and investment and every reason to circumvent them. The service sector paid no heed; its growth has gotten the attention of the government, which instituted a five-year plan in 2011 to prioritize the development of service economy along with trade in services (TIS). Still, the services sector’s share of GDP in China is much lower than countries like the U.S. (79%), Japan (73%), Brazil (69%) and India (57%). (For more, see: Chinese Sector Investing with ETFs.)

The Bottom Line

China's economy has grown by leaps and bounds over the last several decades but still has a ways to go to modernize and reach parity with more-developed countries. Its service economy is now the largest contributor to its GDP, but its size still lags that of other developed nations. China's leadership is focused on changing this, however, with its 12th Five Year Plan, which addresses its dependence on exports. Its construction and industrial sector it still outsized, as befitting a still-developing nation, and its agricultural sector contributes 10% to GDP, way above the 1% of more developed nations. (For more, see: Investing in China.)

China’s GDP is broadly contributed by three broader sectors or industries – primary industry (agriculture), secondary industry (construction and manufacturing) and tertiary industry (the service sector). As per the 2013 data, primary industry accounted for 10% of GDP, while secondary industry accounted for 44%, and tertiary industry 46%.

Massive Agricultural Sector

China is the world’s largest agricultural economy with farming, forestry, animal husbandry and fisheries accounting for approximately 10% of its GDP. This percentage is much higher than developed countries, such as the United States, the United Kingdom and Japan, where agriculture makes up about 1% of GDP. The chart below shows the trend in the share of agriculture in GDP (1983-2013). Though the percentage has gradually decreased over the years, it still accounts for approximately 34% of the total employed population. Over the last seven years, the share of agriculture as part of GDP has held more or less constant at 10%.

The economic reforms of 1978 changed the face of agriculture in China. Prior to these reforms, four out of five Chinese worked in agriculture. But this changed as property rights in the countryside took hold and led to the growth of small nonagricultural businesses in rural areas. De-collectivization, coupled with better prices for agricultural products, led to more productivity and more efficient use of labor. The other major change took place in 2004 when the farm sector started to receive increased support under a major shift in economic policy wherein the government came up with policies to support the agriculture sector rather than overtax it, which was the previous policy. (For more, see: Top Agricultural Producing Countries.)

Construction and Industry

Construction and industry (including mining, manufacturing, electricity, water and gas) accounted for 44% of China's GDP in 2013. Industry is the bigger contributor (84% of the secondary industry), while construction accounts for just 7% of overall GDP. The chart below shows the percentage of secondary industry in China’s GDP from 1983 to 2013. Overall, this sector has held its dominance and seen minimal change in its percentage composition in the overall GDP over the years. Approximately 30% of China's employed population works in these secondary industries. (For more, see: Investing in China's Roads and Railways.)

The share of secondary industries as part of GDP in China is more than in countries such as India (25%), Japan (26%), the U.S. (20%) and Brazil (25%). China is a world leader in industrial output, including mining and ore processing, processed metals, petroleum, cement, coal, chemicals and fertilizer. It's also a leader in machinery manufacturing, armaments, textiles and apparel. Add to that, China is a top manufacturer of consumer products, a leader in food processing, and a major maker of telecommunications equipment. It's a growing manufacturer of automobiles, train equipment, ships, aircraft and even space vehicles, including satellites.

The Service Sector

China's service sector has doubled in size over the last two decades to account for about 46% of GDP. In 2013, it surpassed China's the secondary industries for the first time. Within the service sector are transport, storage and post (5% of GDP), wholesale and retail trades (10%), hotel and catering services (2%), financial services (6%), real estate (6%) and mishmash of services categorized as 'other' (18%).

China’s focus on manufacturing left the service sector to its own devices for many years, with both substantial barriers to trade and investment and every reason to circumvent them. The service sector paid no heed; its growth has gotten the attention of the government, which instituted a five-year plan in 2011 to prioritize the development of service economy along with trade in services (TIS). Still, the services sector’s share of GDP in China is much lower than countries like the U.S. (79%), Japan (73%), Brazil (69%) and India (57%). (For more, see: Chinese Sector Investing with ETFs.)

The Bottom Line

China's economy has grown by leaps and bounds over the last several decades but still has a ways to go to modernize and reach parity with more-developed countries. Its service economy is now the largest contributor to its GDP, but its size still lags that of other developed nations. China's leadership is focused on changing this, however, with its 12th Five Year Plan, which addresses its dependence on exports. Its construction and industrial sector it still outsized, as befitting a still-developing nation, and its agricultural sector contributes 10% to GDP, way above the 1% of more developed nations. (For more, see: Investing in China.)

Trade Like a Top Hedge Fund

What can technical traders see that you don’t? Investopedia presents Five Chart Patterns You Need to Know, your guide to technical trading like the pros. Click here to get started, and learn how to read charts like an industry veteran.

No comments:

Post a Comment